Complete Your Grad Student Tax Return (and Understand It, Too!) Webinar

A tax workshop for graduate & professional students receiving stipends

Taxes are confusing! Especially when you are a funded grad/professional student! This workshop breaks down how to calculate your taxable income from your salary, stipend, fellowship, grant, and/or scholarships; minimize your tax liability using education tax benefits; and report your income, qualified education expenses, and estimated tax paid on your tax return.

This workshop, presented by Dr. Emily Roberts, personal finance educator specializing in early-career PhDs, is appropriate for US citizens, permanent residents, and residents for tax purposes (International students), and comprises pre-recorded videos, worksheets, and live Q&A calls. **This is targeted to grad & professional students who are funding – receiving stipends.

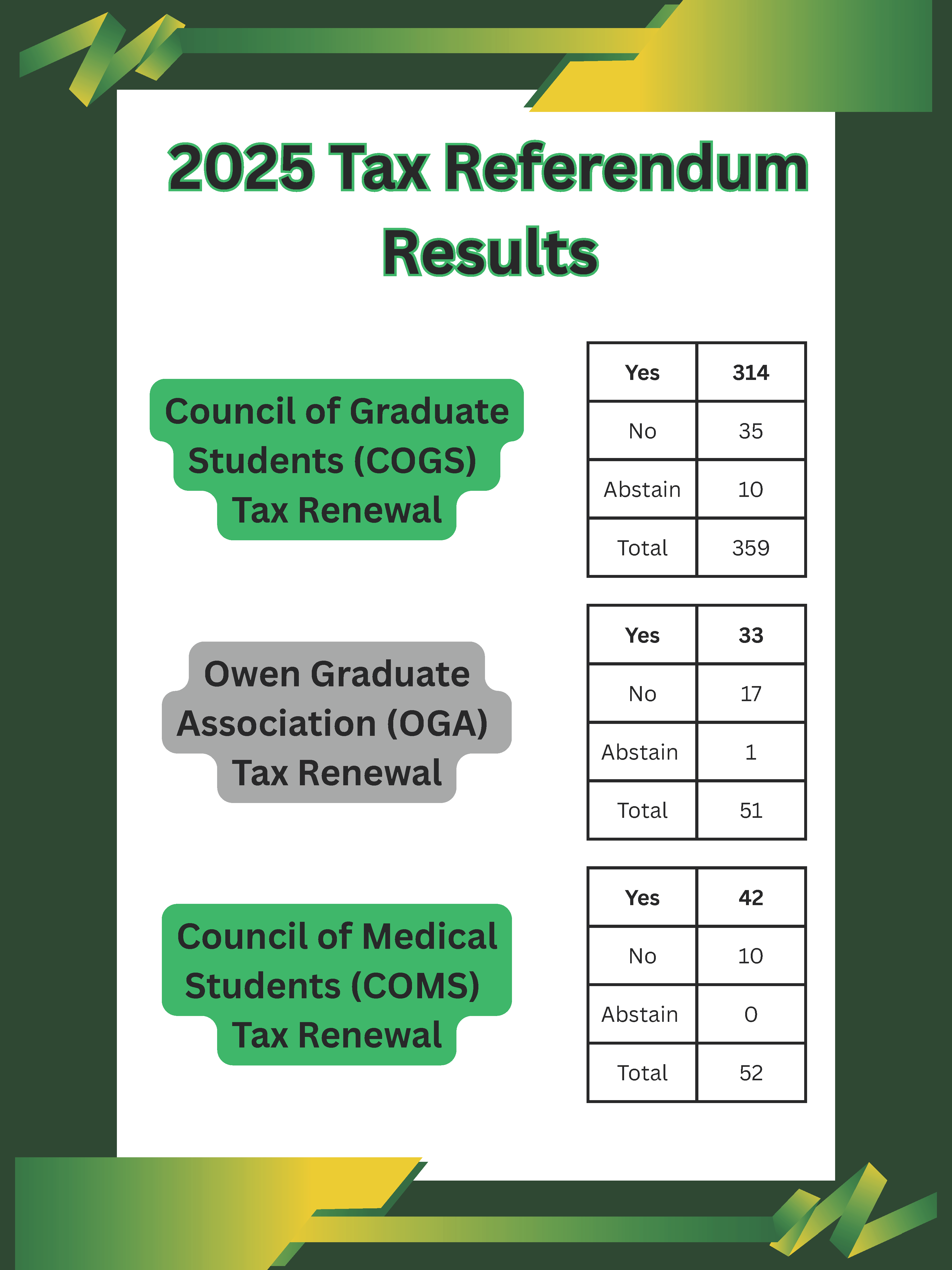

Workshop is $5.00 with the remaining cost subsidized by the Council of Graduate Students (COGS) and The Graduate Office of Well-Being (GROW) for the first 100 MSU graduate & professional students to register.

Register Here: https://bit.ly/GROWCOGS Must sign up with valid MSU Email. Once successfully registered, you will be directed to a login page to access the workshop materials and can get started right away. Notifications for live QA sessions are sent to the registrant’s email.

Dr. Emily Roberts is a personal finance educator specializing in early-career PhDs and has led several popular personal finance workshops for graduate students at MSU.

Workshop is co-sponsored by the Council of Graduate Students (COGS) and the Graduate Office of Well-Being (GROW).

Leave a Reply

Want to join the discussion?Feel free to contribute!